Calculate depreciation rate from effective life

If a motor vehicle has been deemed by the tax office to have a useful life of five years its. Monthly depreciation using the actual days averaging method.

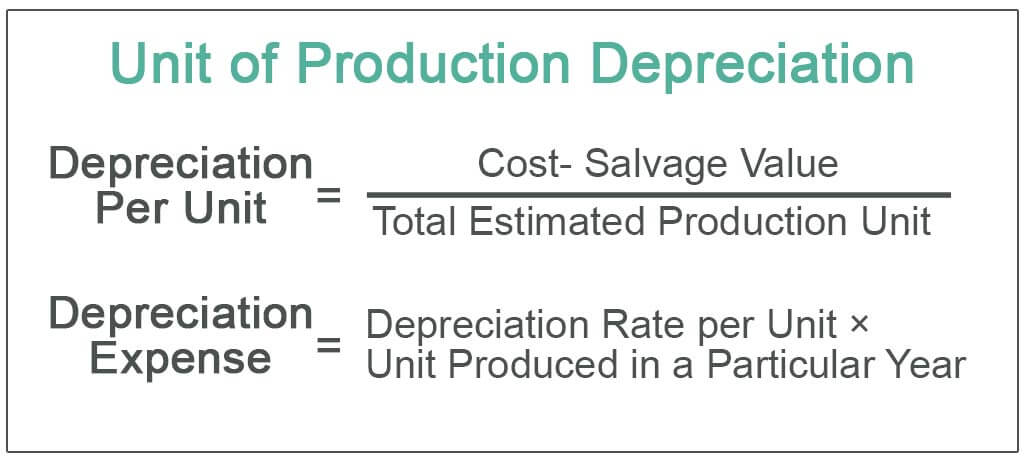

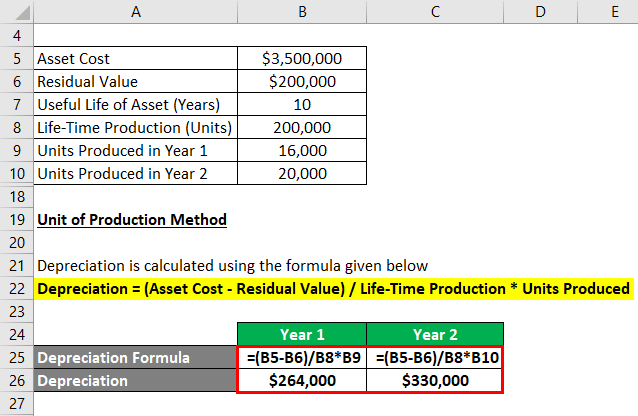

Unit Of Production Depreciation Method Formula Examples

Cost of running the car.

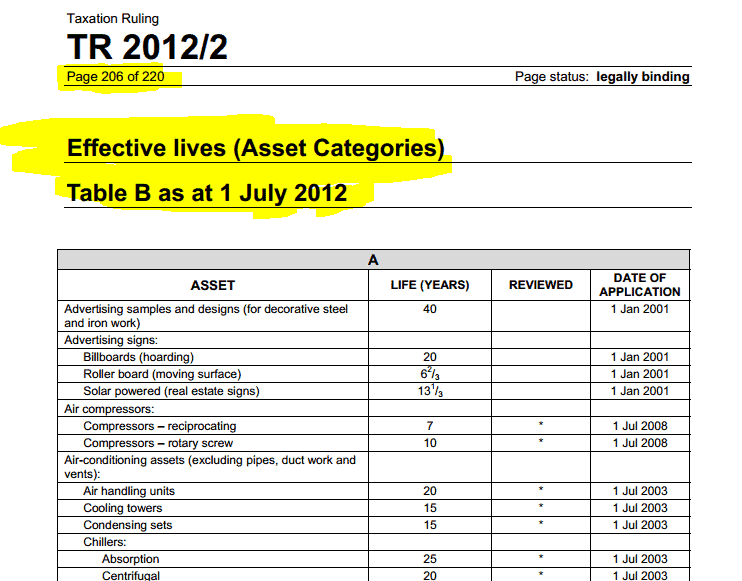

. The below types of formula can be used to calculate the depreciation rate. For most depreciating assets you can use the ATOs. This depreciation method calculates the decrease in values of an asset over its effective life at a fixed rate per year using the following formula.

Up to 8 cash back Annual depreciation by multiplying the depreciable value of the asset by the depreciation rate. Get Started In Your Future. Effective Life Diminishing Value Rate Prime Cost Rate Date of Application.

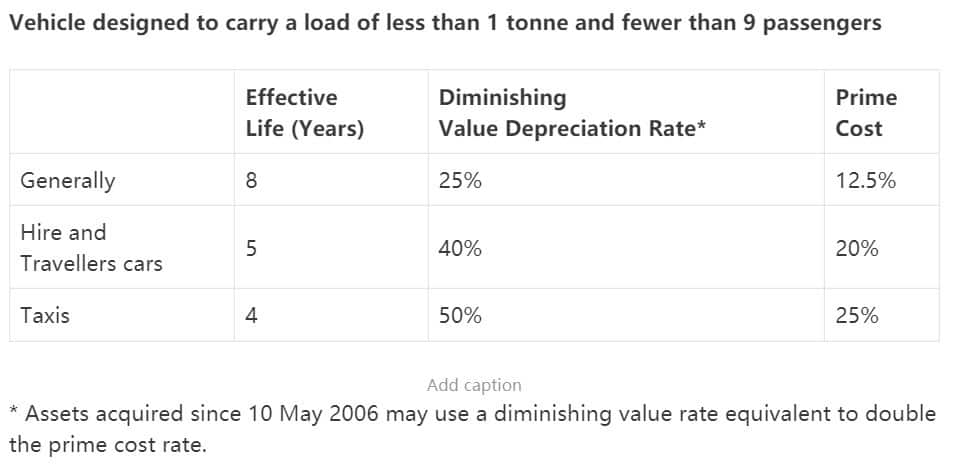

Ad Find A One-Stop Option That Fits Your Investment Strategy. Depreciation of passenger vehicles for tax purposes can be claimed when used to produce taxable income. Once an assets effective life in years is found to calculate depreciation requires conversion to a percentage rate.

You can use this tool to. Assets cost x days held. Calculate depreciation for a business asset using either the diminishing value.

The calculator can also be used to ascertain the value of the car you will get on its sale. Up to 8 cash back Annual depreciation by multiplying the depreciable value of the asset by the depreciation rate. The effective life is used to work out the assets decline in value or depreciation for which an income tax deduction can be claimed.

What is the percentage depreciation and dollar depreciation if cost new is 60000. For example the diminishing value depreciation rate for an asset. Depreciation of most cars based on ATO estimates of useful life is.

Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. Convert effective life to percentage rate. Name Effective Life.

A house has a remaining economic life of 45 years. It is calculated by dividing 200 by an assets useful life in years 150 if the asset was held before 10 May 2006. Using the depreciation table below.

Its effective age is 15 years. An assets depreciation rate is determined by its useful life. ATO Depreciation Rates 2021 Table A.

Depreciation rate finder and calculator. Find the depreciation rate for a business asset. The below types of formula can be used to calculate the depreciation rate Cost of running the car Days you owned the car 365 X 100 Effective life in years lost value.

Monthly depreciation using the full month or actual days averaging. Total Economic LIfe.

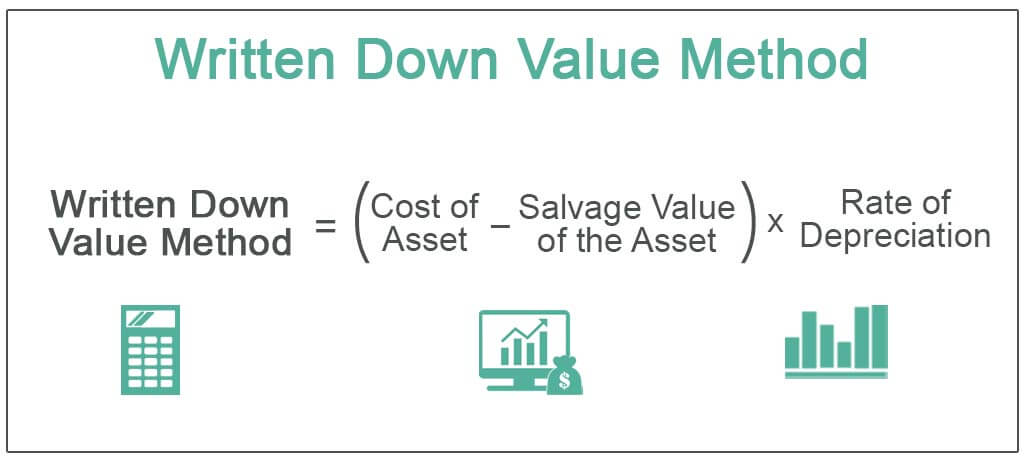

Written Down Value Method Of Depreciation Calculation

Depreciation Of Vehicles Atotaxrates Info

Ato Depreciation Rates Atotaxrates Info

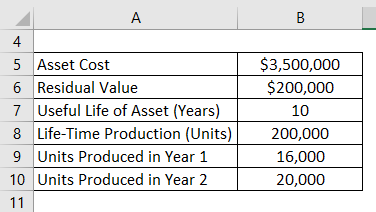

Depreciation Formula Examples With Excel Template

Depreciation Change In Useful Life Youtube

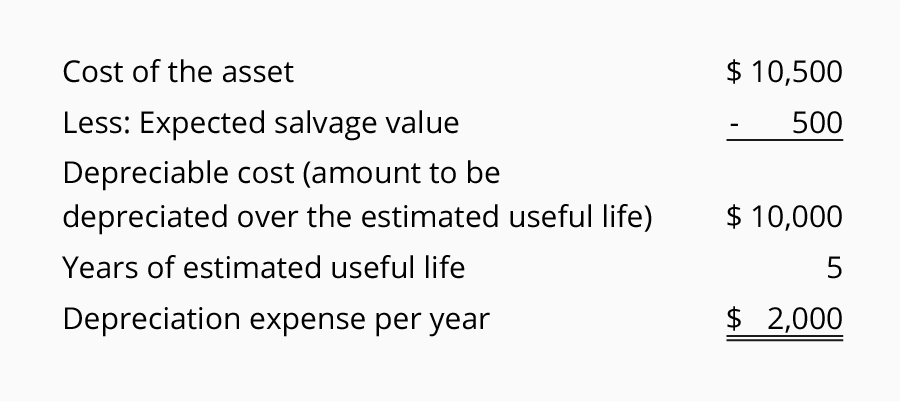

Straight Line Depreciation Accountingcoach

Depreciation Rate Formula Examples How To Calculate

Ato Depreciation Rates Atotaxrates Info

Depreciation Formula Examples With Excel Template

How To Calculate Book Value 13 Steps With Pictures Wikihow

How To Calculate Depreciation Youtube

Depreciation Formula Examples With Excel Template

Declining Balance Depreciation Calculator

Depreciation Calculation

Depreciation Rate Formula Examples How To Calculate

Depreciation Formula Examples With Excel Template

Depreciation Rate Formula Examples How To Calculate